Democratically elected politicians tend to push the cost of financial crises to the future in order to avert unpopularity

Autocracies have traditionally been thought more spendthrift than democracies which manage money prudently in order to maintain favour with the public to whom they are accountable. But is this true? According to Christopher Gandrud and Mark Hallerberg, not necessarily, as politicians in democratic polities are more likely to push the costs to the future rather than take a hit in popularity.

As the recent financial crisis has highlighted, assisting banks in response to crises can be very expensive. The prevailing wisdom before this crisis was that autocracies spent more on financial crises than democracies. In previous research (by Keefer in 2007, and Rosas in 2006 and 2009), autocrats were argued to use public resources to bail-out their cronies at struggling banks in exchange for rents–cheap loans, cash bribes, and so on. Elected politicians, on the other hand, need to appeal to cost-conscious voters wary of expensive bailouts. So, these politicians were believed to respond to crises with less fiscally costly policies, like closing failing banks and imposing losses on creditors.

The Global Financial Crisis raises some questions about this approach. Though commonly referred to as “global”, the crisis primarily struck highly electorally competitive democracies in Europe and North America. Yet there is considerable variation across countries in the policy choices that these countries have made and the fiscal costs that have materialised so far from them (see Laeven and Valencia, 2012)

In light of recent events, does the proposition that autocracies spend more than democracies responding to financial crises still hold up? We tackle this issue in a paper recently published in the journal Research and Politics. We re-evaluate findings made by Keefer in 2007 using an updated and expanded data set of fiscal costs from financial crises. We find evidence that democracies and autocracies do not in fact differ in how much they spend on resolving financial crises.

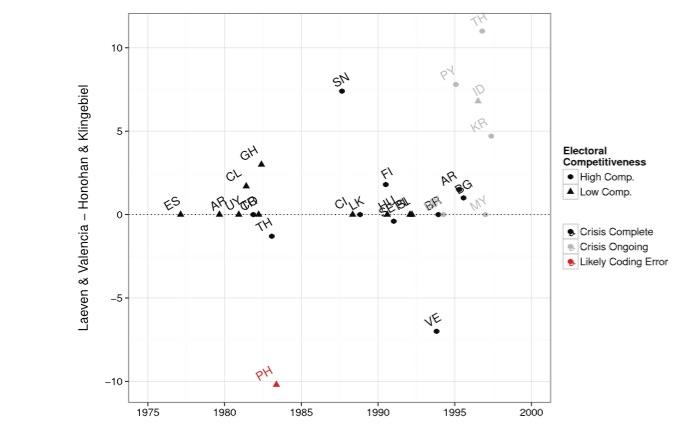

First we reran the original analysis using updated data on the costs of financial crises. This included crises over the period 1975-2000. Perhaps the main global data set on the fiscal costs of financial crises is created by a shifting team of World Bank and IMF researchers. Keefer used a version of this data set from 2003. A more recent version was released in 2012 by Laeven and Valencia. The newer data contains considerable revisions. Figure 1 shows the difference in fiscal costs between the two versions. Positive values indicate that fiscal costs were more than estimated in the earlier data. Negative values mean that costs were lower than earlier believed.

Figure 1: Difference in fiscal costs of crisis responses as a percentage of GDP recorded by Laeven and Valencia (2012) and Honohan and Klingebiel (2003)

We can see that in general, when revisions are made, costs end up being larger than previously believed. This is especially true of crises that were labelled as ‘ongoing’ in the 2003 version of the data. Many of these crises occurred in countries with competitive elections. As such, it is not surprising that when we rerun the original models with the updated data we find no evidence for a difference in fiscal costs between democracies and autocracies.

We then ran the models using data for costs through the recent crisis. Again, we find no evidence that autocracies spend more than democracies in response to crises.

Why might this be?

Autocrats, insulated from voters, may certainly spend large amounts to bail out their banking cronies. While democratic politicians face pressures from voters to contain costs that may ultimately lead to tax increases and/or spending cuts, these same voters pressure politicians to assist failing banks. Voters want financial stability. Financial crises have a number of direct and indirect negative effects for many, if not most voters. Bank failures threaten depositors’ funds. Financial crises suppress economic output, especially when the financial sector is economically important and interconnected. Crises depress the value of financial assets thus hurting individuals and pension funds’ portfolios. They can also lead to mass unemployment.

Thus democratic politicians face a dilemma: how can they please voters who want financial stability, but also do not want expensive bailouts?

One possibility is that politicians choose policies that assist banks, but do not create publicly declared costs until some point in the future, perhaps after elections. Such policies include bank liability guarantees, public asset management companies that acquire and dispose of distressed assets, and emergency liquidity assistance. All of these policies enable politicians to assist troubled banks, while not facing the full cost of this assistance until the future.

This behaviour helps us explain why autocracies were originally believed to spend more than democracies, but using updated data this finding is not supported. Cronyistic autocrats can simply bail-out banks with policies whose costs are born immediately. Democratic politicians bail-out banks more using policies that shift costs into the future. Thus data collected soon after a crisis will fairly accurately reflect fiscal costs for autocracies, but it will take many years before an accurate assessment of costs in democracies is available.

—

This post represents the views of the authors and not those of Democratic Audit or the LSE. Please read our comments policy before posting.

—

Christopher Gandrud is a Lecturer in Quantitative International Political Economy at City University London, and Post-Doctoral REsearch as the Fiscal Governance Centre, Hertie School of Governance in Berlin.

Christopher Gandrud is a Lecturer in Quantitative International Political Economy at City University London, and Post-Doctoral REsearch as the Fiscal Governance Centre, Hertie School of Governance in Berlin.

Mark Hallerberg teaches Public Management and Political Economy at the Hertie School of Governance. He also maintains an affiliation with the Political Science Department at Emory University, Atlanta, Georgia.

Mark Hallerberg teaches Public Management and Political Economy at the Hertie School of Governance. He also maintains an affiliation with the Political Science Department at Emory University, Atlanta, Georgia.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

[…] Democratically elected politicians tend to push the cost of financial crises to the future in order …. […]

Democratically elected politicians push the cost of financial crises into future, to avert unpopularity https://t.co/k4jg85n7iX

Democratically elected politicians tend to push the cost of financial crises to the future to avert unpopularity: https://t.co/rNVhzZppj7

Democratically elected politicians tend to push the cost of financial crises to the future in order to avert unpop… https://t.co/O8GT1bQL9J

Democratically elected politicians tend to push the cost of financial crises to the future in order to avert u… https://t.co/yAdLuliXJ5

New @democraticaudit piece w/ @mhallerberg on dem politicians pushing the costs of crises into the future https://t.co/J7bzssFels @Res_Pol

Democratically elected politicians tend to push the cost of financial crises to the future… https://t.co/O6wbdTiLFw https://t.co/U8nVRLpZ8x