The ‘rule of thumb’ that left-wing parties cause inflation is probably bogus – and has democratic implications

Do left-wing parties really cause inflation? And do right-wing parties really cause low inflation, but high unemployment? These well-worn tropes are influential in elections, but do they hold up? Research by Christopher Gandrud and Cassandra Grafström suggests that the former does not, even if political debate continues to factor it in.

Inflation mgnet? (Credit: underclassrising.net, CC BY SA 2.0)

A common rule of thumb among economists is that left-wing governments pursue polices that lower unemployment, but cause inflation. Right-wing governments are expected to implement lower inflation policies even at the cost of lowered employment. How well do these expectations relate to reality? Do these common expectations spill over into real world policies? Recent experiences suggest that there actually isn’t much difference in economic policies under left and right-wing governments. So, what are the consequences of monetary policy-makers sticking to these rules of thumb if they are inaccurate? In a recent paper (gated and ungated) we investigated these questions by looking at the United States Federal Reserves’ inflation forecasts.

Monetary policy-making is inherently forward-looking. Interest rates are set with expectations of future inflation in mind. In pursuit of price stability, modern central banks aim for moderate inflation. In the UK the legal goal is two percent. Crudely, if central bankers think that inflation will be too high, then they raise interest rates to tamp it down. This tends to also slow economic growth and employment. Central bankers can respond to inflation that is too low by lowering interest rates. This tends to also increase economic growth and employment. Expectations about inflation have an important impact on the everyday economic lives of us all.

When inflation is overestimated, monetary policies could be chosen that inappropriately slow growth. On the other hand, when it is underestimated, policies might be implemented that fuel economic growth and possibly bubbles in the future.

To see how accurate inflation expectations are, we looked at about forty years of forecasts made by the United States Federal Reserve. We found that, regardless of what economic policies were pursed, the Fed tended to overestimate inflation when the president was a Democrat and underestimate inflation for Republicans.

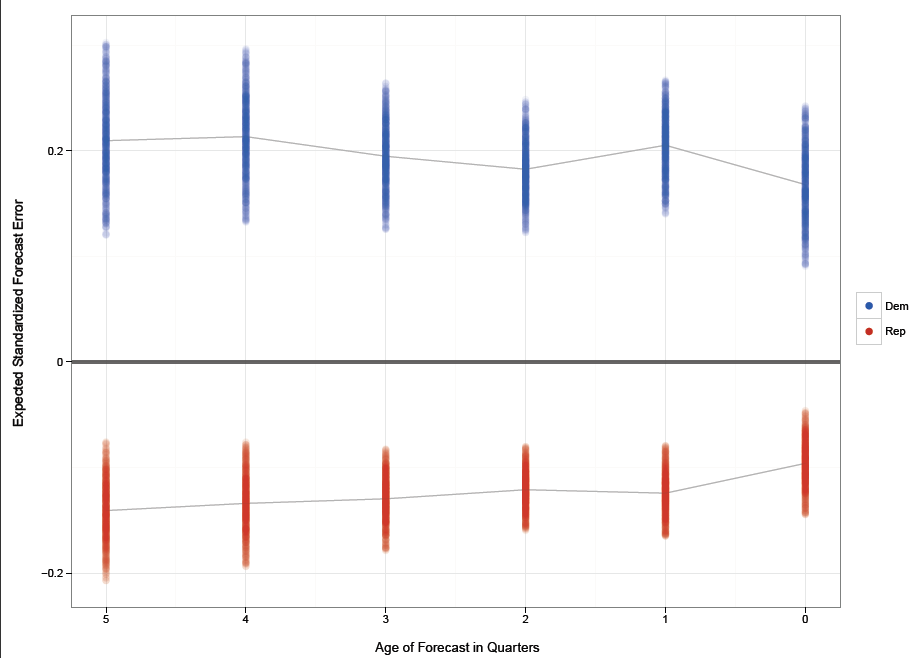

The first figure below shows our predictions about the forecasting errors that that the Fed makes when the president is a Democrat (blue bars) compared to when they are a Republican (red bars). We controlled for a variety of economic and policy conditions, including government expenditure, interest rate changes, unemployment, and recessions. Because the lines move closer to zero—a perfect forecast—as the forecasted period nears, we can see that the later a forecast is made the more accurate it is. Nonetheless, even when making forecasts for the present quarter there are still distinct partisan differences. We found that inflation in the present quarter tends to be underestimated by about 10 percent when the president is a Republican and overestimated by about 15 percent when they are a Democrat.

Figure 1: Simulated expected inflation forecast error for Republican and Democratic presidencies

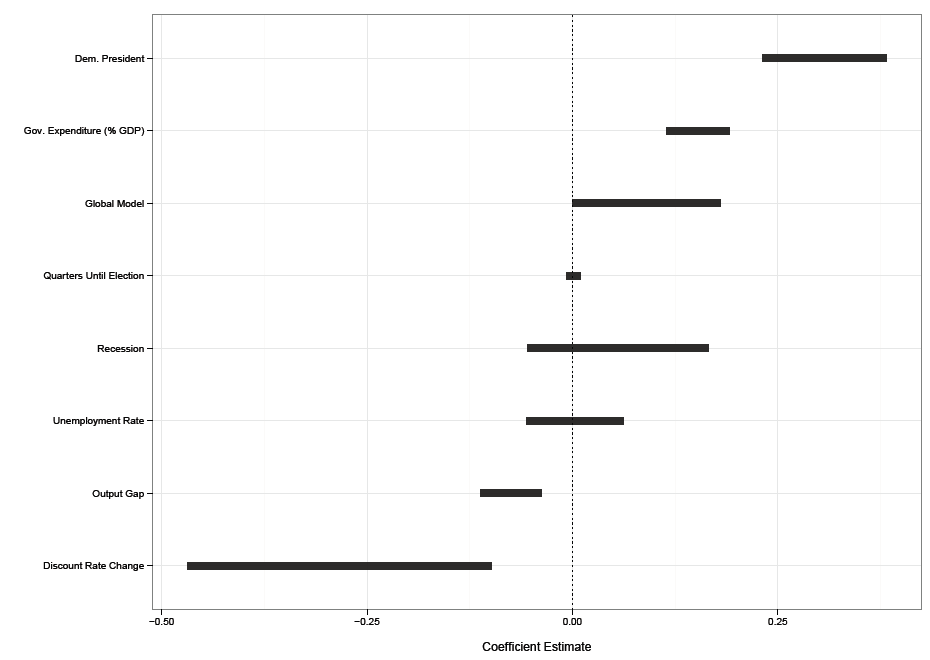

Not only do Fed forecasters anticipate that Democratic presidents will have a bigger impact on inflation than they actually do, but forecasters also expect government spending to increase inflation more than it does. In the next plot we show key coefficient estimates from our models. The important take away is that estimates above 0 are associated with inflation overestimates. Those below zero are associated with underestimates. Again we see inflation is overestimated during Democratic presidencies. Government expenditure as a percentage of GDP is also strongly associated with overestimates.

Figure 2: 95 percent confidence bands for association with Fed inflation forecasting errors

Overestimates for Democratic presidents and government spending are related. In the partisan-inflation rule of thumb, left-wing parties, pursuing lower unemployment, cause higher inflation by trying to boost the economy with government spending. More government spending increases the supply of money in the economy and so the value of money goes down—inflation. However, our findings show that Fed forecasters overestimate the effect of these policies on price stability for governments on both sides of the aisle.

Incorrect rules of thumb could lead central bankers to raise or lower interest rates at inappropriate times. For left-wing governments they may keep interest rates too high, constricting growth. And for right-wing governments they could keep interest rates too low, fueling economic growth in the short to medium-term, but possibly causing bubbles in the future. Neither of these outcomes is desirable from an economic standpoint.

What’s more, we know that economic well-being is strongly related with voters’ choices. If the economy is doing well, incumbents are more likely to be re-elected. When it is doing poorly they are more likely to be kicked out. Using incorrect rules of thumb to predict inflation could lead to monetary policies that unfairly handicap left-wing parties in elections and provide for a boost to right-wing incumbents.

—

Note: this post represents the views of the author, and not those of Democratic Audit or the LSE. Please read our comments policy before posting.

—

Christopher Gandrud is a Post-Doctoral Researcher at the Fiscal Governance Centre, Hertie School of Governance. His research focuses on the international political economy of public financial and monetary institutions, as well as applied social science statistics. He has been a Lecturer in International Relations at Yonsei University and a Fellow in Government at the London School of Economics where in 2012 he completed a PhD in political science.

Christopher Gandrud is a Post-Doctoral Researcher at the Fiscal Governance Centre, Hertie School of Governance. His research focuses on the international political economy of public financial and monetary institutions, as well as applied social science statistics. He has been a Lecturer in International Relations at Yonsei University and a Fellow in Government at the London School of Economics where in 2012 he completed a PhD in political science.

Cassandra Grafström is a PhD candidate at the University of Michigan. Her research focuses on democratic accountability broadly, with a particular focus on the intersection between economic performance, election timing, and election outcomes in advanced industrial countries. She was previously a pre-doctoral fellow at the Hertie School of Governance.

Cassandra Grafström is a PhD candidate at the University of Michigan. Her research focuses on democratic accountability broadly, with a particular focus on the intersection between economic performance, election timing, and election outcomes in advanced industrial countries. She was previously a pre-doctoral fellow at the Hertie School of Governance.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

MT @PSRMJournal: @ChrisGandrud and Cassandra Grafstrom’s @PSRMJournal paper referenced on https://t.co/Po43TtOE14 https://t.co/OlpAqophGv

@ChrisGandrud and Cassandra Grafstrom’s @PSRMJournal paper referenced on https://t.co/5w5BzmDLLh -… https://t.co/jGIBjn7Nqd

The ‘rule of thumb’ that left-wing parties cause inflation is probably bogus … – Democratic Audit UK https://t.co/QH2TnahYea

The ‘rule of thumb’ that left-wing parties cause inflation is probably bogus – and has democratic implications https://t.co/8bLt3AjKze

The ‘rule of thumb’ that left-wing parties cause inflation is probably bogus – and has democratic implications https://t.co/NBatGg4GYw