Economic globalisation reduces electoral turnout

Politicians frequently pay lip-service to the forces of globalisation, and in particular they have shaped political debates around wages, housing and immigration. But what impact have these impersonal forces had on political participation? Drawing on recent research, Stephen Fisher and John Marshall argue that the impact of globalisation has been to reduce electoral turnout due to the increased freedom of financiers and the advance of cross-border transactions.

(Credit: Ricardo Liberato: CC BY SA 2.0)

Between 1970 and 2007, the average industrialized democracy experienced a decline in electoral turnout of almost 9 percentage points. To the extent that politicians pander to the demands of those who actually turn out, this trend risks redefining the relationship (or lack of it) between citizens and government.

Over the same period, global economic integration has increased dramatically. While trade, as a percentage of GDP, has grown by 31 percentage points, foreign ownership has increased spectacularly. Rising from close to zero in the post-war period, foreign direct investment and international stock ownership now represent more than 100% of GDP in many countries.

The popular press and many social scientists are fond of blaming such economic globalisation for all sorts of problems. In our recently published article in the British Journal of Political Science, we ask whether and, if so, how economic globalisation – dependence on mobile capital and international trade – has affected political participation.

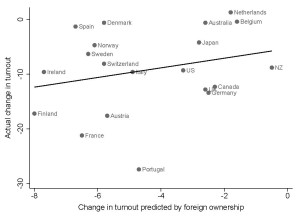

We find that economic integration explains a substantial portion of the decline in turnout experienced by high-income democracies. In particular, high levels of foreign capital ownership are the main source of globalisation’s deleterious effect on political participation.

How does globalisation affect electoral turnout?

Our main argument is that because financiers are increasingly able to quickly transfer large sums of money across borders, they can (threaten to) hold domestic governments to ransom. Not only are foreign corporations and investors not accountable to the domestic government and its objectives; domestic equivalents also become less encumbered by domestic regulations as opportunities to move operations abroad become increasingly feasible. Consequently, governments of all colours become scared of “spooking markets” that might cause investments crucial for economic growth to leave. This cycle of market power is self-perpetuating: countries become more dependent on international finance, and governments face greater economic, and thus electoral, costs of intervention.

We argue – with the support of existing empirical research by Timothy Hellwig among others – that voters understand these changes. Voters recognize that all types of government in more globalised economies face powerful constraints on their tax, industrial and regulatory policies. Although some policy dimensions are relatively unaffected by globalisation, total government spending is likely to decline as governments lower tax rates to accommodate international financial interests. As current events in Greece suggest, international financial and political pressure can play a key role in determining domestic policy.

This may explain the de facto policy convergence documented by Jonas Pontusson and David Rueda as well as other scholars, even if such convergence is not openly claimed by parties with incentives to differentiate themselves. Combined with the reduced government spending that accompanies globalisation, voters care less about who governs and thus have less reason to bother voting.

Bankers or merchants?

Since it is much easier and quicker to move capital than is it to change international trade patterns, it is the actions of bankers rather than merchants that cause globalisation to reduce turnout. Within capital flows, it is the threat of the most mobile sources of finance that produce the largest effects. Furthermore, an array of previous evidence shows that capital losses have more severe economic consequences than trade shifts. Governments can thus afford to be more belligerent towards traders that may be unable to credibly threaten to trade in different markets.

What does the evidence show?

We test these arguments using government statistics and electoral data from 23 OECD countries from 1970 to 2007. Essentially, we examine whether changes in electoral turnout follow from changing levels of economic integration.

Plausibly estimating globalization’s impact on turnout faces two major empirical challenges. First, highly globalised nations may experience different rates of turnout from less globalized nations for other reasons. To ensure that our estimates do not simply capture cross-national cultural or institutional differences, we focus on within-country comparisons across elections. Second, since globalization has consistently risen throughout the period of our study, it is all too easy to blame globalisation for other long run trends that may be unrelated. To address this “spurious correlation” concern, we use statistical techniques to “detrend” the data for each country and thus focus on fluctuations around a country’s long-term trends. In sum, we effectively test whether a sudden jump in economic integration is associated with a drop in turnout.

Our results are stark. We find that an increase in the share of (inward plus outward) foreign direct investment (FDI) and particularly portfolio equity flows, which are smaller (typically stock market) investments that do not pass the ownership threshold to be defined as FDI, substantially reduces electoral turnout. The effects of trade, however, are relatively muted. Our estimates – shown for countries with relatively long financial series in the figure below – imply that the dependence on international capital induced by economic globalisation may account for two-thirds of the decline in turnout, or six percentage points from an OECD average of nine.

In addition to this direct channel, we find that globalisation also reduces total government spending. This result opposes a large literature – based on less rigorous empirical methods – which has claimed that governments increased their spending to compensate voters for losses associated with international finance or trade. We find that spending reductions reinforce globalization’s effects on turnout, presumably by further reducing incentives for voters to turn out when there is a smaller pie to split.

Implications

We recognise that bankers and financiers are just agents of globalisation, doing what they can for themselves as the laws permit. It is the increasing liberalisation of laws governing capital mobility and the failure of governments to act collectively to counteract increasing capital flows that ultimately underpin this challenge to democracy. Unfortunately, it remains unclear if or how long-term political participation can be reinvigorated as globalisation continues apace.

By reducing turnout, globalisation poses an important challenge to democratic accountability. While the range of feasible economic policies available to governments may have declined, there remains considerable leeway to push different distributional agendas. Some governments may emphasize health care, while others focus on education or crime reduction. In addition, as political participation wanes and interests come to the fore, it becomes more difficult to elect the competent politicians required to deal with crises and to implement policy reforms effectively.

—

This post was originally published on The Plot and is reposted with the permission of the authors. To see the full British Journal of Political Science article on which this article is based, click here.

It represents the views of the author and does not give the position of Democratic Audit or the LSE. Please read our comments policy before responding.

—

Stephen Fisher is Associate Professor in Political Sociology and the Fellow and Tutor in Politics at Trinity College, University of Oxford. Follow him on Twitter @StephenDFisher. He runs the Elections Etc website.

Stephen Fisher is Associate Professor in Political Sociology and the Fellow and Tutor in Politics at Trinity College, University of Oxford. Follow him on Twitter @StephenDFisher. He runs the Elections Etc website.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Democratic Audit's core funding is provided by the Joseph Rowntree Charitable Trust. Additional funding is provided by the London School of Economics.

Economic globalisation reduces electoral turnout https://t.co/O1k2we8LKT

Economic globalisation reduces electoral turnout https://t.co/IiiuP2Fzvx #Option2Spoil

Economic globalisation reduces electoral turnout https://t.co/JahoMjae6l https://t.co/RV7VEnpraG